10 signatures reached

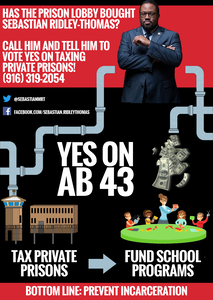

To: Assemblyman Sebastian Ridley-Thomas

VOTE YES TO TAX PRIVATE PRISONS

Call Sebastian Ridley-Thomas and tell him to VOTE YES on taxing private prisons: (916) 319-2054

Why is this important?

Education NOT Incarceration!

California Assembly Bill 43 taxes companies that profit from the prison industry to fund preschool and after school programs that prevent incarceration in the first place. We want our kids to go to college, not jail!

But Assemblyman Sebastian Ridley-Thomas is blocking the bill from moving out of his Revenue and Tax Committee. We're ONE VOTE AWAY from getting this important bill out of that committee. Has Sebastian been bought out by the prison lobby?

Call him and tell him to VOTE YES to taxing private prisons and funding school programs that prevent incarceration.

BACKGROUND

California spends huge amounts to incarcerate prisoners. Current active contracts between for-profit companies and the California Department of Corrections and Rehabilitation total approximately $4.5 billion. In comparison, the state spends relatively little on programs known to prevent incarceration.

Attempts to invest heavily in incarceration prevention programs have been stymied by budget concerns. Without a permanent non-budgetary funding source, these efforts are unlikely to experience continued success.

Companies continue to profit as a result of high state incarceration rates. These for-profit companies provide necessary goods and services to state facilities, often at a markup. In effect, taxpayers are stuck footing the bill, enabling companies to see large profits for goods and services due to California’s prison population.

SOLUTION

Assess a tax on companies that contract with state prison facilities to provide goods or services. The tax targets those companies that profit financially from an individual’s incarceration and causes those companies to give revenue back to the state that will be used to prevent and/or reduce future incarceration. Funds collected will be deposited into the State Incarceration Prevention Fund in order to provide prevention services.

This tax is structured to come from company revenue and is not simply passed along to the state through increased bid prices. Language has been included that 1) requires contracting companies to certify under penalty of perjury that the cost is not being passed along to the state, 2) calls for oversight and potential audit by the Board of Equalization and 3) institutes a civil fine for companies found to be violators. Fines too will be deposited into the fund, further increasing the amount of available money for incarceration prevention.

ENDORSEMENTS

California Teachers Association (sponsor)

Anti-Recidivism Coalition

California Federation of Teachers

California Nurses Association

Californians for Justice

First 5 Association of California

Partnership for Children and Youth

SEIU California

California Assembly Bill 43 taxes companies that profit from the prison industry to fund preschool and after school programs that prevent incarceration in the first place. We want our kids to go to college, not jail!

But Assemblyman Sebastian Ridley-Thomas is blocking the bill from moving out of his Revenue and Tax Committee. We're ONE VOTE AWAY from getting this important bill out of that committee. Has Sebastian been bought out by the prison lobby?

Call him and tell him to VOTE YES to taxing private prisons and funding school programs that prevent incarceration.

BACKGROUND

California spends huge amounts to incarcerate prisoners. Current active contracts between for-profit companies and the California Department of Corrections and Rehabilitation total approximately $4.5 billion. In comparison, the state spends relatively little on programs known to prevent incarceration.

Attempts to invest heavily in incarceration prevention programs have been stymied by budget concerns. Without a permanent non-budgetary funding source, these efforts are unlikely to experience continued success.

Companies continue to profit as a result of high state incarceration rates. These for-profit companies provide necessary goods and services to state facilities, often at a markup. In effect, taxpayers are stuck footing the bill, enabling companies to see large profits for goods and services due to California’s prison population.

SOLUTION

Assess a tax on companies that contract with state prison facilities to provide goods or services. The tax targets those companies that profit financially from an individual’s incarceration and causes those companies to give revenue back to the state that will be used to prevent and/or reduce future incarceration. Funds collected will be deposited into the State Incarceration Prevention Fund in order to provide prevention services.

This tax is structured to come from company revenue and is not simply passed along to the state through increased bid prices. Language has been included that 1) requires contracting companies to certify under penalty of perjury that the cost is not being passed along to the state, 2) calls for oversight and potential audit by the Board of Equalization and 3) institutes a civil fine for companies found to be violators. Fines too will be deposited into the fund, further increasing the amount of available money for incarceration prevention.

ENDORSEMENTS

California Teachers Association (sponsor)

Anti-Recidivism Coalition

California Federation of Teachers

California Nurses Association

Californians for Justice

First 5 Association of California

Partnership for Children and Youth

SEIU California